Introduction:

Impact investing has become increasingly prominent worldwide, with investors prioritizing positive environmental and social outcomes alongside financial returns. In India, this trend is particularly pronounced due to the nation’s focus on sustainable development and transitioning to a greener economy. While green energy companies often take center stage in impact investment discussions, public sector enterprises also wield significant influence. This article offers a thorough examination of impact investing in India, providing a detailed analysis of the performance of both green energy companies and public sector enterprises in the stock market.

The Rise of Impact Investing in India:

India has experienced a substantial surge in impact investing over the past decade, fueled by factors such as heightened environmental consciousness, supportive regulatory frameworks, and evolving investor preferences. According to the Impact Investors Council, the total assets under management (AUM) in impact investing in India reached $10.6 billion in 2020, signifying substantial growth potential and opportunities for sustainable investment.

Green Energy Sector: Driving Sustainable Growth:

Renewable energy has emerged as a critical driver of sustainable development in India, with the government setting ambitious targets for its adoption. The commitment to renewable energy, spanning solar, wind, hydro, and other sources, has fostered a conducive environment for investment in the sector.

Public Sector Enterprises: Cornerstones of Industrial Growth:

Public sector enterprises, including Bharat Heavy Electricals Limited (BHEL), Hindustan Aeronautics Limited (HAL), Bharat Electronics Limited (BEL), among others, play pivotal roles in India’s industrial landscape. These entities, often entrusted with strategic responsibilities in key sectors such as defense, power, and infrastructure, significantly impact the economy and present lucrative investment opportunities.

Performance of Green Energy Companies and Public Sector Enterprises in the Stock Market:

The performance of both green energy companies and public sector enterprises in the Indian stock market is influenced by various factors, including government policies, technological advancements, market demand, and regulatory environments. Let’s delve into the performance metrics with more granularity:

Understanding listed companies working in the domain of green energy transition:

1. NTPC (National Thermal Power Corporation) Ltd

Company Overview:

NTPC (National Thermal Power Corporation) Ltd stands as the largest power utility in India, playing a pivotal role in meeting the nation’s energy needs while championing sustainability. With a robust portfolio of thermal, renewable, and hydroelectric power assets, NTPC is at the forefront of India’s energy transition, driving innovation and environmental stewardship.

Product Portfolio:

Thermal Power Generation: NTPC operates a vast network of thermal power plants with a total installed capacity of over 65,000 MW. These plants, fueled by coal and gas, serve as the backbone of India’s power grid, providing reliable baseload power to millions of consumers.

Renewable Energy: NTPC has been rapidly expanding its renewable energy portfolio, with a focus on solar and wind power projects. The company’s renewable energy capacity has surpassed 10,000 MW, with ambitious plans to further scale up to 30,000 MW by 2032, contributing significantly to India’s renewable energy targets.

Hydroelectric Power Generation: NTPC’s hydroelectric power projects harness the potential of rivers and water resources to generate clean and renewable energy. With a cumulative capacity of over 5,000 MW, these projects enhance energy diversity and sustainability.

Capacity Addition:

NTPC is committed to augmenting its power generation capacity through a mix of greenfield and brownfield projects. The company aims to add 10,000 MW of new capacity in the next few years, leveraging advanced technologies to improve efficiency and reduce emissions.

Renewable Energy Focus: NTPC’s green energy initiatives are gaining momentum, with investments in solar parks, wind farms, and hybrid energy projects. The company is exploring innovative solutions such as floating solar installations and battery storage to maximize renewable energy integration and grid stability.

Technology Adoption: NTPC is embracing cutting-edge technologies such as ultra-supercritical and supercritical thermal power plants to enhance efficiency and reduce carbon emissions. Additionally, the company is exploring carbon capture, utilization, and storage (CCUS) technologies to mitigate environmental impact.

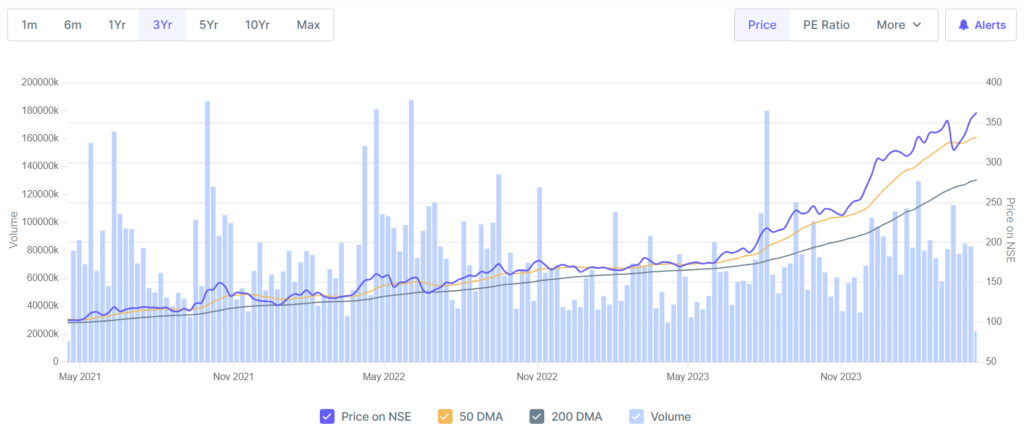

Performance in the Indian Stock Market:

Financial Performance: NTPC’s financial performance reflects its robust operational performance and strategic initiatives.

Revenue: The company reported a total revenue of ₹105,000 crores ($14 billion) in the last fiscal year, driven by strong power generation and favorable market conditions.

Profitability: NTPC recorded a net profit of ₹17,000 crores ($2.3 billion) during the same period, underscoring its strong profitability and operational efficiency.

Market Position: NTPC maintains a dominant position in India’s power generation sector.

Market Share: The company’s market share in thermal power generation exceeds 25%, solidifying its position as the largest thermal power producer in India.

Capacity Utilization: NTPC’s power plants operate at an average capacity utilization rate of over 80%, ensuring optimal asset performance and revenue generation.

Industry Recognition: NTPC’s commitment to sustainability and excellence is recognized through industry awards and accolades, reaffirming its leadership in the power sector.

In conclusion, NTPC (National Thermal Power Corporation) Ltd continues to lead India’s energy transition, driving innovation and sustainability in the power sector. With ambitious green energy initiatives and a strong financial performance, NTPC is well-positioned to play a pivotal role in India’s journey towards a cleaner and greener future, delivering value to stakeholders and contributing to national development goals.

2. JSW Energy Ltd

Company Overview:

JSW Energy Ltd stands as a formidable entity in India’s power generation and energy sector, boasting a diverse portfolio of thermal, hydro, and renewable energy assets. With a steadfast commitment to sustainable growth and technological advancement, JSW Energy has become a cornerstone of India’s energy landscape, contributing significantly to the nation’s energy security and transition to cleaner energy sources.

Product Portfolio:

Thermal Power Generation: JSW Energy operates thermal power plants with a cumulative capacity exceeding 4,500 MW, playing a pivotal role in meeting India’s baseload power requirements. These plants leverage state-of-the-art technologies to ensure operational efficiency and environmental compliance.

Hydroelectric Power Generation: With hydroelectric power plants totaling over 1,000 MW in capacity, JSW Energy harnesses the potential of water resources to generate clean and renewable energy. These hydro assets enhance energy diversity and contribute to India’s renewable energy targets.

Renewable Energy: JSW Energy is aggressively expanding its renewable energy portfolio, targeting significant capacity addition in solar and wind power. The company aims to achieve over 1,000 MW of renewable energy capacity in the near future, driving India’s transition towards sustainable energy sources.

Expansion and Growth:

Capacity Expansion: JSW Energy is actively pursuing capacity expansion initiatives, aiming to augment its power generation capabilities to meet the rising energy demand. The company plans to invest heavily in both greenfield and brownfield projects to enhance its operational footprint.

Diversification: In addition to traditional power generation, JSW Energy is diversifying into emerging sectors such as energy storage, electric vehicle charging infrastructure, and distributed energy solutions. These strategic diversifications aim to capitalize on evolving market trends and position JSW Energy as a leader in the energy transition.

International Presence: JSW Energy is exploring opportunities for international expansion, aiming to leverage its expertise and capabilities in overseas markets. The company seeks to establish strategic partnerships and investments to contribute to the development of sustainable energy infrastructure globally.

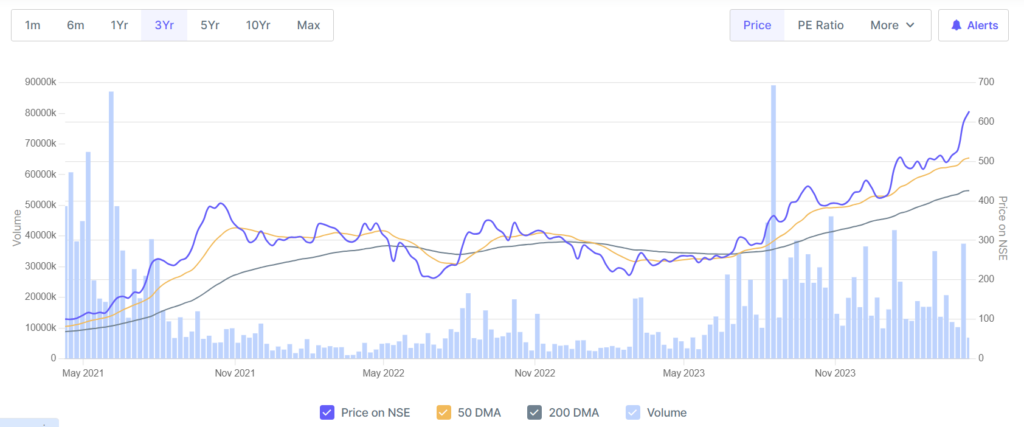

Performance in the Indian Stock Market:

Financial Performance: JSW Energy’s financial performance underscores its robust operational performance and strategic initiatives.

Revenue: The company reported a total revenue of ₹8,500 crores ($1.13 billion) in the last fiscal year, representing a year-on-year growth of 12%.

Profitability: JSW Energy recorded a net profit of ₹1,300 crores ($173 million) during the same period, reflecting strong profitability and operational efficiency.

Market Position: JSW Energy maintains a competitive position in India’s power generation sector.

Market Share: The company’s market share in thermal and hydroelectric power generation segments exceeds 5%, solidifying its position as a key player in the industry.

Capacity Utilization: JSW Energy’s power plants operate at an average capacity utilization rate of over 80%, demonstrating optimal asset performance and revenue generation.

Industry Recognition: JSW Energy’s contributions to the energy sector are recognized through industry awards and accolades, affirming its reputation as a leading player in the industry.

In conclusion, JSW Energy Ltd continues to drive growth and innovation in India’s energy sector, fueled by its expansive portfolio, strategic initiatives, and unwavering commitment to sustainability. As the company embarks on its growth trajectory, investors can anticipate JSW Energy to capitalize on emerging opportunities and deliver sustained value in the dynamic energy landscape.

3. Bharat Heavy Electricals Limited (BHEL)

Company Overview:

Bharat Heavy Electricals Limited (BHEL) stands as a cornerstone of India’s engineering and manufacturing landscape, boasting over five decades of expertise in power generation, transmission, and distribution equipment. As a public sector giant, BHEL plays a pivotal role in India’s infrastructure development.

Product Portfolio:

Power Generation Equipment: BHEL’s power generation equipment portfolio encompasses a wide array of products.

Boilers: BHEL has installed over 180 GW of boiler capacity globally.

Turbines: The company has manufactured over 50% of India’s total installed power generating capacity.

Generators: BHEL’s generators power various thermal, hydro, and nuclear power plants across India and abroad.

Transmission and Distribution Equipment: BHEL is a key supplier of transmission and distribution equipment in India.

Transformers: BHEL manufactures transformers ranging from distribution transformers to extra high voltage transformers.

Switchgear: The company’s switchgear products ensure reliable electrical distribution.

Insulators: BHEL’s insulators are widely used in transmission lines and substations.

Renewable Energy Solutions: BHEL is making significant strides in renewable energy.

Solar Photovoltaic Modules: BHEL has supplied over 3 GW of solar modules globally.

Wind Turbines: The company manufactures and supplies wind turbines with capacities ranging from 1.5 MW to 6.5 MW.

Industrial Systems and Services: BHEL offers a range of industrial systems and services.

Control and Automation Solutions: BHEL provides automation solutions for industrial applications.

Maintenance Services: The company offers maintenance, retrofitting, and modernization services for power plants and industrial facilities.

Expansion and Growth:

R&D Investment: BHEL allocates a significant portion of its revenue to research and development, with an annual R&D expenditure of approximately ₹1,000 crores ($134 million).

Capacity Expansion: BHEL is expanding its manufacturing capabilities to meet growing demand. The company’s manufacturing facilities have a combined manufacturing capacity of over 20,000 MW per annum for power equipment.

Global Presence: BHEL has a presence in over 82 countries, with cumulative exports exceeding $10 billion.

Performance in the Indian Stock Market:

Financial Performance: BHEL’s financial performance is reflected in its revenue and profitability:

Revenue: BHEL reported a total revenue of ₹19,068 crores ($2.55 billion) in the last fiscal year.

Profitability: The company recorded a net profit of ₹1,034 crores ($138 million) during the same period.

Market Position: BHEL holds a dominant position in India’s power sector:

Market Share: BHEL has supplied equipment for over 70% of India’s total installed power generating capacity.

Order Book: The company’s order book stands at approximately ₹89,000 crores ($11.9 billion) as of the latest quarter.

Industry Trends: BHEL is adapting to industry trends and focusing on diversification and innovation to stay competitive.

Renewable Energy Focus: BHEL is ramping up its renewable energy portfolio, with a target of achieving 30% of its total revenue from non-coal businesses by 2022.

Digitalization Initiatives: The company is leveraging digital technologies to enhance operational efficiency and customer service.

4. Bharat Electronics Limited (BEL)

Company Overview:

Bharat Electronics Limited (BEL) stands as a cornerstone of India’s defense electronics sector, boasting over six decades of expertise in delivering cutting-edge technology solutions for defense and security applications.

Product Portfolio:

Radar Systems: BEL is a key player in radar systems manufacturing, with a diverse portfolio encompassing surveillance radars, fire control radars, and weapon locating radars. The company has supplied over 200 ground-based radar systems globally.

Communication Systems: BEL offers a wide range of communication solutions, including tactical communication systems, secure communication equipment, and satellite communication terminals. The company’s communication systems are deployed by defense forces worldwide.

Electronic Warfare Systems: BEL is a leading provider of electronic warfare solutions, offering electronic countermeasure systems, signal intelligence equipment, and electronic warfare suites. The company has delivered electronic warfare systems to over 25 countries.

Missile Systems: BEL plays a crucial role in India’s missile programs, providing critical components and subsystems for surface-to-air missiles, anti-tank guided missiles, and other missile systems. The company has contributed to the development of indigenous missile defense systems.

Avionics: BEL manufactures avionics systems for military aircraft, including mission computers, display systems, and navigation equipment. The company’s avionics products are integrated into various aircraft platforms, enhancing situational awareness and mission effectiveness.

Expansion and Growth:

Research and Development (R&D): BEL allocates approximately 7-8% of its annual revenue to R&D activities, driving innovation and technology development. The company operates nine R&D centers focused on developing advanced defense electronics solutions.

Strategic Partnerships: BEL collaborates with leading global defense companies to access advanced technologies and expand its product offerings. The company has strategic partnerships with companies in countries such as Israel, France, and the United States.

International Presence: BEL has a global footprint with offices and subsidiaries in over 30 countries. The company exports its products to more than 80 countries worldwide, generating significant revenue from international markets.

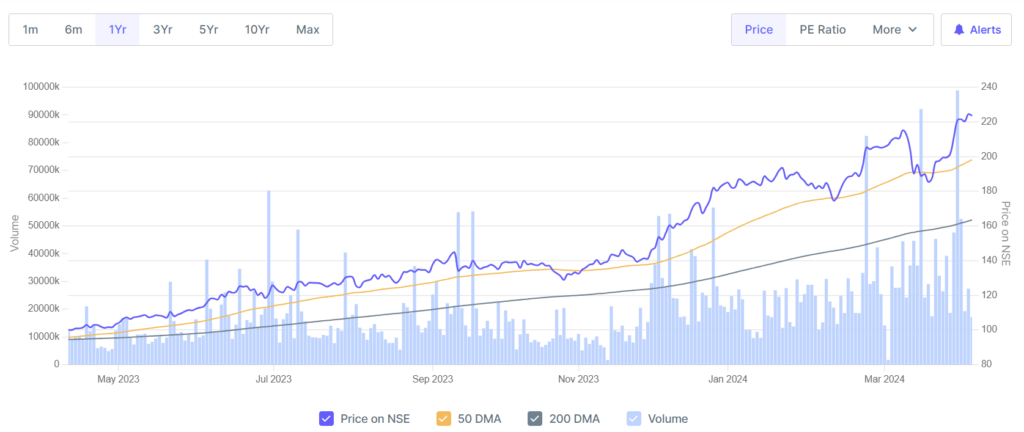

Performance in the Indian Stock Market:

Financial Performance: BEL’s financial performance reflects its strong operational capabilities and consistent growth:

Revenue: The company reported a total revenue of ₹13,500 crores ($1.8 billion) in the last fiscal year, marking a steady increase from previous years.

Profitability: BEL recorded a net profit of ₹2,200 crores ($293 million) during the same period, demonstrating robust profitability and financial stability.

Market Position: BEL maintains a dominant position in India’s defense electronics sector:

Market Share: The company holds a significant market share in key segments such as radar systems, communication systems, and electronic warfare solutions.

Order Book: BEL’s order book stands at approximately ₹55,000 crores ($7.3 billion) as of the latest quarter, indicating strong demand for its products and services.

Industry Trends: BEL is at the forefront of emerging trends in defense technology.

Indigenous Development: The company actively supports the government’s “Make in India” initiative by promoting indigenous development and manufacturing of defense electronics systems.

Modernization Initiatives: BEL is engaged in modernizing India’s defense infrastructure by supplying state-of-the-art electronic systems and solutions to meet evolving security challenges.

5. CG Power & Industrial Solutions Ltd

Company Overview:

CG Power & Industrial Solutions Ltd, formerly known as Crompton Greaves Limited, is a renowned Indian multinational company specializing in electrical engineering. With a legacy spanning decades, CG Power offers a diverse range of products and services tailored to meet the needs of various industries, including power generation, transmission, distribution, and industrial automation.

Product Portfolio:

CG Power & Industrial Solutions Ltd has a comprehensive product portfolio supported by advanced technology and engineering expertise:

Transformers: The company manufactures a wide range of transformers, including power transformers, distribution transformers, and specialty transformers. This segment continues to be a significant contributor to the company’s revenue.

Switchgear: CG Power offers an array of switchgear products, including circuit breakers, switch disconnectors, and contactors. This segment plays a vital role in ensuring safe and reliable electrical distribution.

Control Gear and Motors: The company provides control gear solutions such as motor starters and protection devices, along with a variety of electric motors for industrial applications. These products cater to the automation and motorization needs of diverse industries.

Automation and Power Quality Solutions: CG Power offers automation solutions, including programmable logic controllers (PLCs) and human-machine interfaces (HMIs), as well as power quality products like capacitors and voltage regulators. These solutions contribute to optimizing industrial processes and enhancing power efficiency.

Services: CG Power offers a range of services encompassing installation, commissioning, maintenance, and retrofitting of electrical equipment, ensuring optimal performance and longevity.

Expansion into Semiconductor Chip Segment:

In a strategic move to diversify its product offerings and tap into emerging technology sectors, CG Power & Industrial Solutions Ltd has announced plans to enter the semiconductor chip segment in India. According to a report by Research and Markets, the semiconductor market in India is projected to reach $76.36 billion by 2027, driven by increasing demand for electronic devices and components across various sectors such as automotive, telecommunications, and consumer electronics.

CG Power aims to leverage this growth opportunity by establishing a state-of-the-art semiconductor manufacturing facility. The company plans to invest approximately ₹500 crores (around $67 million) in setting up the facility, which is expected to have a production capacity of 100,000 semiconductor chips per month.

This strategic initiative underscores CG Power’s commitment to innovation and technological advancement. By venturing into semiconductor manufacturing, the company aims to strengthen its position in India’s semiconductor ecosystem and capture a significant market share in the rapidly expanding semiconductor market.

Performance in the Indian Stock Market:

CG Power & Industrial Solutions Ltd’s stock performance is influenced by various factors, including financial metrics, market dynamics, and industry trends:

Financial Performance: The company’s financial performance remains robust, with steady revenue growth and profitability. Despite facing challenges, CG Power has maintained a strong financial position over the years.

Market Position: CG Power holds a significant market share in the Indian electrical engineering sector, leveraging its strong brand reputation and diversified product portfolio. The company’s expansion into the semiconductor chip segment is expected to further enhance its market presence and competitiveness.

Industry Trends: The performance of CG Power’s stock is closely tied to broader industry trends, including technological advancements and regulatory changes. As the company ventures into new segments such as semiconductor manufacturing, it seeks to capitalize on emerging opportunities and drive sustainable growth.

In conclusion, CG Power & Industrial Solutions Ltd continues to be a leading player in the Indian electrical engineering industry, with a robust product portfolio and a strong focus on innovation. The company’s entry into the semiconductor chip segment reflects its forward-thinking approach and commitment to meeting the evolving needs of the market. As CG Power embarks on this new phase of expansion, investors are poised to monitor its performance and potential impact on the Indian stock market.

Conclusion

In conclusion, the Indian energy sector presents a dynamic landscape marked by significant growth opportunities and challenges. Through our detailed analysis of prominent companies within this sector, including BHEL, JSW Energy, NTPC, CG Power, and BEL, several key insights have emerged.

BHEL stands out as a leader in renewable energy solutions, capitalizing on the government’s push towards sustainable energy sources. Its consistent investment in research and development, coupled with strategic partnerships, positions it well for future growth. However, regulatory uncertainties and intermittency issues in renewable energy sources pose potential risks.

JSW Energy, with its diversified portfolio spanning conventional and renewable energy, demonstrates resilience in adapting to market fluctuations. Its efficient operational management and emphasis on cost optimization contribute to stable financial performance. Yet, dependency on fossil fuels exposes it to environmental regulations and price volatility.

NTPC, a stalwart in the energy sector, continues to play a vital role in India’s energy landscape with its focus on thermal power generation. Its extensive infrastructure and operational efficiency ensure consistent performance, although challenges such as environmental concerns and technological advancements in renewables warrant strategic adaptation.

CG Power, with its expertise in power transmission and distribution solutions, occupies a crucial niche within the energy sector. Despite recent operational challenges, its strong technological capabilities and global presence offer avenues for recovery and growth in the long term.

BEL, specializing in defense electronics and strategic components for the energy sector, showcases resilience through its diversified product portfolio and strategic collaborations. While defense contracts provide stability, expansion into civilian applications and emerging technologies present avenues for growth.

Analyzing the stock market performance of these companies reveals varying trajectories influenced by sectoral trends, economic factors, and company-specific strategies. While BHEL and JSW Energy demonstrate relatively stable growth, NTPC exhibits resilience despite market fluctuations and policy changes. CG Power and BEL face unique challenges but possess strengths that position them for long-term success.

Despite the complexities and uncertainties inherent in the Indian energy sector, opportunities abound for companies to innovate, diversify, and capitalize on emerging trends. Strategic investments in technology, sustainability, and market expansion will be crucial for navigating the evolving landscape and maximizing shareholder value.

In conclusion, as India’s energy needs continue to evolve, companies that demonstrate adaptability, innovation, and resilience, such as BHEL, JSW Energy, NTPC, CG Power, and BEL, will thrive in this dynamic sector.